Employing Our Troops

CCG is a strong supporter of our troops and—as part of our company's initiative—we developed a process that gives companies the ability to claim the government incentives for creating jobs for veterans. Companies can receive a Federal income tax credit ranging from $2,400 to $4,800 for each qualified veteran hired. In addition to the Federal-level benefits, 39 states have state-sponsored Enterprise Zones. The majority of these states allow employers to claim credits for a portion of employee wages paid to veterans.

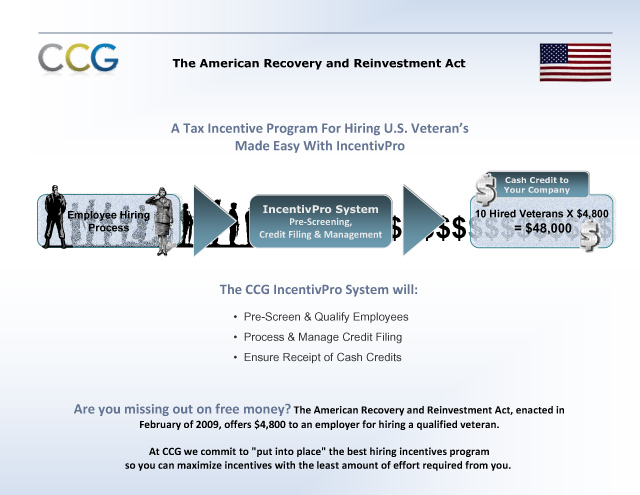

If your company is hiring veterans, CCG can assist you with the documentation, processing, and securing of your incentives.

Our proprietary technology automates the qualifying process for these lucrative tax credits, and performs the following functions:

- Confirms that a business is located in a specified Federal or state incentive Zone.

- Confirms certain employees working at a specific location either live in specified areas or meet other "qualification" criteria.

- Automatically calculates the credit that is generally a percentage of W-2 wages and number of weeks worked.

- Auto populates federal or state tax forms, eliminating human error and improving compliance.

- Sets up systems to allow the employer to pre-screen the employees before they are hired, streamlining the documentation process and maximizing the hiring credits.

These business hiring credits, and the tax savings achieved, result in enhanced cash flow, lower labor costs, and lower after-tax capital expenditures. Amended returns for three years or more are allowed for Federal purposes, and certain states also allow amended return refunds—which can average over $100,000 in many cases. Ultimately, by claiming these tax incentives, the business owners are rewarded for their hiring practices and veterans become better positioned to achieve employment.

To learn more about our partner program, please contact Mark DaBell at (626) 737-6109.